Caught The Train But Missed The Station

There is nothing more powerful than an idea whose time have come. Blockchain technology will completely change how we organise and use data for the betterment of societies. However only one blockchain will emerge as the underlying protocol and this will be Bitcoin SV.

Thursday, May 13, 2021

Caught The Train But Missed The Station !

Monday, March 22, 2021

Non Fungible Tokens (NFT's) The Ultimate Store Of Value

NFT's are all the rage today and nearly everyman (woman) and his dog is or is trying to get in on this phenomenon. A Banksy art was purchased digitised, and turned into a NFT . The original was burnt. It sold for $380,000 in eth. Artists, celebrities, musicians are flocking to cash in by turning their creations into NFTs.

Even Elon Musk is getting in on the act selling his own NFT - A song about NFT!

What Is An NFT?

An NFT is basically a digital file on a blockchain and is therefore verifiably time stamped and immutable, provided it is embedded into a public distributed blockchain. ( BTC, ETH, Cosmos, Polkadot ... )

The first NFT was known as a token and in those days and was issued on a project called Counterparty (XCP) on the Bitcoin blockchain. Anyone can create one or any number of copies of a token using the counterparty dapp. The first SOG token (NFT) was the FDCARD issued by Everdream Soft, as a game card in their turn based game called Spells Of Genesis.

Because a Counterparty transaction is still a transaction on the BTC blockchain, Counterparty fell into disuse as the cost of BTC transactions escalated. It has now made a comeback especially as the value of these NFT cards start attaining ever higher values.

The FDCARD also known as "The Healing Formula"

Only 200 copies and it is arguably iconic for Bitcoin and the Blockchain. This card sold for $6000 back in 2016, with fractions of it selling for up to $27,000. It was a quirk that this card was divisible and some people bought fractions of the card thus destroying its' value. Small fraction owners can therefore hold to ransom the owner of the majority part of the card!

Representing the story of the very first Bitcoin Exchange, Mt Gox, its hack. The saga continues to this days with liquidators and claimants still fighting over the "carcass".

Battle For Blocksize

Representing the very bitter fight within the community which led to the Bitcoin Cash fork.

Satoshi Lite also known as The Imposter

Charlie Lee, inventor of Litecoin, ask Shaban to portray himself as The Imitator. This card sold at the NFT auction for $3300.

What gives an NFT value?

Like anything else including Bitcoin it is Usefulness, Adoption and Scarcity. Bitcoin (Btc) has an advantage over gold in that it is easier to use as a medium of exchange without the cost of storage.

NFTs that represents digital art are valued because of the beauty of the artwork and/or the reputation of the artist. Most importantly the copyright of that image belongs to the token holder. In future, it will be paid to the token holder through the blockchain without the owner ever needing to do anything about it.

NFTs can also be issued by celebrities, artists and musicians, the value of which depends on their following. Yes songs can also be digitised and made into and NFT. These are collectibles and they include Pepe tokens the main items being auction at @nftauctions. It is only worth what someone will pay for it and its' value can go up or down.

Game Card NFTs in addition to being collectibles, are useful for their attributes in a game. The bigger the community playing the game the higher the demand and therefore value. Crypto Kitties, and SOG cards are examples.

A Special Place For Spells Of Genesis NFTs.

This is my opinion only and I believe that Some Spell Of Genesis NFTs especially those that tell the Bitcoin and Blockchain story and are issued in limited quantities between 2015 and 2016 will fetch very high value. ( See list of all cards here. )

The artwork is tasty, meaningful and professional and they are in limited supply. Satoshicard is only limited to 200 copies and who knows how many copies have already been lost. They are rarer than lambos.

The value fetch by FDCARD at @nftauctions of $45,000 and $3300 for SATOSHI LITE on 21 March 2021 is proof that these SOG NFT cards will be very sought after. Like Bitcoin (BTC) they were there first. They can be dated back to 2015, and there will never be anymore of them.

Is this a flash in the pan? There will be another auction on April 3 and the new auction lot is being put up for inspections now. I believe that this will be an ongoing event very much reminiscent of the early days of Bitcoin when BTC was traded on message boards and chatrooms all on trust. No doubt it will be formalised and professionalised in the near future.

As these eye popping prices keep rising, there will be more interest and we will have a huge positive feedback loop.

What can an NFT be used for ?

1) Commemorate an event

2) Represent a digital artwork

3) Copyright ownership of an artwork

4) Ticketing access to clubs, events and such

5) Prestige of ownership if disclosed

6) Store of value

7) It is not a cryptocurrency

Store of value depends on all the attributes above and more perhaps. An NFT Card has only X number of copies in existence. It is of value to the people who played a part in the event. Gox card represents such an event.

A card like the Genesis Card represents the birth of Bitcoin and thus will have wide interest even to people not particularly interested in Cryptocurrencies.

A card like Satoshicard was the apex card even among SOG enthusiast then. The fact that it depicted a mysterious like character " Yoda Like " makes it even more appealing even if we eventually agree on who Satoshi really is.

It is not a cryptocurrency and this is important. Blockchain tokens are always increasing and decreasing in value. Even if the price of BTC collapses a quality NFT will hold its' value. This is important for those holding crypto to hedge their risk of ownership.

This market is huge and this fact has not really sunk in. FDCARD sold for $45,000 and by extension total FDCARD value is $13.50 million. This places it at no 845 ( Coin Gecko) by market capitalisation, and it is only 1 Card in the SOG stable. Clearly this is a new asset class and deserves a ranking category all on its' own.

The future is bright for NFTs.

Appendix

Counterparty : https://www.coingecko.com/en/coins/counterparty

Everdream Soft : Company owned by Shaban Shaame a Swiss national. SOG was build on his original card role playing game called MOONGA.

Spells Of Genesis : Turn based game using attribute cards.

FDCARD Bidding History

Theo Goodman, [21.03.21 12:02]

BOOM

Zaafar, [21.03.21 12:02]

5000

Mysterious Aesthetic, [21.03.21 12:02]

$10k

Xcer, [21.03.21 12:02]

11111

Theo Goodman, [21.03.21 12:02]

xcer

Rob, [21.03.21 12:02]

$12k

Xcer, [21.03.21 12:02]

15

Dave, [21.03.21 12:02]

$12.5

Theo Goodman, [21.03.21 12:02]

15k next bid 16k

Xcer, [21.03.21 12:02]

$15

Theo Goodman, [21.03.21 12:03]

[ ✊ Sticker ]

Theo Goodman, [21.03.21 12:03]

do I hear 16k?

Rob, [21.03.21 12:03]

$16k

-, [21.03.21 12:03]

18

Xcer, [21.03.21 12:03]

$17k

Xcer, [21.03.21 12:03]

$20k

Theo Goodman, [21.03.21 12:03]

V top bidder

Rob, [21.03.21 12:03]

$19k

Theo Goodman, [21.03.21 12:03]

xcer 20k

-, [21.03.21 12:03]

25

Theo Goodman, [21.03.21 12:03]

25

Theo Goodman, [21.03.21 12:03]

26k ?

Theo Goodman, [21.03.21 12:03]

[ ✊ Sticker ]

Theo Goodman, [21.03.21 12:04]

[ 👊 Sticker ]

Rob, [21.03.21 12:04]

$26k

Theo Goodman, [21.03.21 12:04]

26k!

got it all offalick 🫀, [21.03.21 12:04]

26.5

-, [21.03.21 12:04]

28

Theo Goodman, [21.03.21 12:04]

28

Theo Goodman, [21.03.21 12:04]

V

Theo Goodman, [21.03.21 12:04]

[ ✊ Sticker ]

Theo Goodman, [21.03.21 12:04]

28 top bid v

Theo Goodman, [21.03.21 12:04]

29

Theo Goodman, [21.03.21 12:04]

29k?

Theo Goodman, [21.03.21 12:05]

[ 👊 Sticker ]

White Rabbit1111, [21.03.21 12:05]

29

Theo Goodman, [21.03.21 12:05]

[ 🤜 Sticker ]

Theo Goodman, [21.03.21 12:05]

29k

Theo Goodman, [21.03.21 12:05]

!

Theo Goodman, [21.03.21 12:05]

[ ✊ Sticker ]

Theo Goodman, [21.03.21 12:05]

do I hear 30k

-, [21.03.21 12:05]

30

Theo Goodman, [21.03.21 12:05]

31k?

got it all offalick 🫀, [21.03.21 12:05]

31

White Rabbit1111, [21.03.21 12:05]

31

White Rabbit1111, [21.03.21 12:05]

32

Theo Goodman, [21.03.21 12:05]

32 white

Theo Goodman, [21.03.21 12:05]

33?

-, [21.03.21 12:05]

35

Theo Goodman, [21.03.21 12:05]

36?

Mysterious Aesthetic, [21.03.21 12:05]

😳

got it all offalick 🫀, [21.03.21 12:06]

[In reply to -]

Sheeesh

White Rabbit1111, [21.03.21 12:06]

36

Theo Goodman, [21.03.21 12:06]

no comments just bids ,thanks

Theo Goodman, [21.03.21 12:06]

36k !

Theo Goodman, [21.03.21 12:06]

[ ✊ Sticker ]

Fredrick, [21.03.21 12:06]

37k

Theo Goodman, [21.03.21 12:06]

38k?

-, [21.03.21 12:06]

40

Theo Goodman, [21.03.21 12:06]

40k!

Theo Goodman, [21.03.21 12:06]

do I hear 41k

Theo Goodman, [21.03.21 12:06]

[ ✊ Sticker ]

Theo Goodman, [21.03.21 12:06]

[ 👊 Sticker ]

White Rabbit1111, [21.03.21 12:06]

41

Theo Goodman, [21.03.21 12:06]

41

Theo Goodman, [21.03.21 12:07]

do I hear 42k

-, [21.03.21 12:07]

42

Theo Goodman, [21.03.21 12:07]

43?

got it all offalick 🫀, [21.03.21 12:07]

43

Theo Goodman, [21.03.21 12:07]

43

Theo Goodman, [21.03.21 12:07]

44?

Theo Goodman, [21.03.21 12:07]

going once

Theo Goodman, [21.03.21 12:07]

[ ✊ Sticker ]

White Rabbit1111, [21.03.21 12:07]

44

Theo Goodman, [21.03.21 12:07]

44

Theo Goodman, [21.03.21 12:07]

[ ✊ Sticker ]

Theo Goodman, [21.03.21 12:07]

[ 👊 Sticker ]

Theo Goodman, [21.03.21 12:07]

[ 🤜 Sticker ]

-, [21.03.21 12:07]

45

Theo Goodman, [21.03.21 12:07]

45k

Theo Goodman, [21.03.21 12:07]

do I hear 46k?

Theo Goodman, [21.03.21 12:07]

[ ✊ Sticker ]

Theo Goodman, [21.03.21 12:08]

[ 👊 Sticker ]

Theo Goodman, [21.03.21 12:08]

[ 🤜 Sticker ]

Theo Goodman, [21.03.21 12:08]

[ 🔥 Sticker ] ( Sold for 45K )

Comments thereafter

Flubito, [21.03.21 12:08]

[ 😰 Sticker ]

MemeConscious 😷, [21.03.21 12:08]

[ 🌜 Sticker ]

mnl Classic Positive Vibes, [21.03.21 12:08]

[ 😔 Sticker ]

Wheeler, [21.03.21 12:08]

V wanted it

Zaafar, [21.03.21 12:08]

STEEAALL

MrHansel, [21.03.21 12:08]

Wooooooowwew

Shaban Spells of Genesis, [21.03.21 12:08] ( Owner of Everdream Soft and SOG game )

Woa

KEKRELOADED, [21.03.21 12:08]

[ GIF ]

Ryan Haigh, [21.03.21 12:08]

wowwwww

White Rabbit1111, [21.03.21 12:08]

[ 👏 Sticker ]

Rob, [21.03.21 12:08]

Moon

Wheeler, [21.03.21 12:08]

[ 💫 Sticker ]

Akshar, [21.03.21 12:08]

Gah le

Dave, [21.03.21 12:08]

Congrats

Other Cards

Bitcoin Origins - Genesis Card

The Stealing Of Mt Gox - GOXCARD

First Bitcoin Fork - Blocksizecd

The Immitator Satoshilite

Monday, April 6, 2020

Paymail is here!! This is the Killer App for BSV mass adoption

How it works.

Your email is the gateway to your moneybutton account. ( Relayx, Handcash )

1) You will need an invite to join the beta and you can do that through this link https://mypaymail.co/

2) Upon approval you will be given a mypaymail account example : 000@mypaymail.io

3) Adding new handles

In addition to your assigned handle you can create more handles as on the left side of the form. Each handle will cost $0.85 cents. You can use any amount of payment destination you wish.

4) What is interesting is the custom domian option on the right side.

If you or your organisation uses a custom domain for your emails, those emails can be linked to your payment destination. This means that anybody can pay you by sending money to your email address not your mypaymail handle.

I reached out to mypaymail on the process and they responded with this message.

|

IONOS » The brand by 1&1 for Mail, Domains and Websites - We are the leading European Web Host und Specialist for Cloud Solutions.

|

Monday, January 27, 2020

Bitcoin SV Next Bull Run

Guess we are all still buzzing over the last BSV price run up! When the dust finally settled BSV is up 300% and holding. So why did the last price hop happened? The main excuse was that CSW got the keys to his bitcoins! I commented then that it is nonsense as it was only a rumour and even if true the impact will be negligible. If the fear was that he would dump BTC to push up BSV then BTC should have experience a significant drop in price.

Those who are into BSV know that it is the original and real Bitcoin and are convince that it will be the only blockchain on which all blockchain apps will be built. The run up in price is only the first phase of existing whales and hedge funds building a position and new money coming into BSV.

Had it just been a CSW rumour then BSV's price would have drop lower than from where it started - about $90. Instead it has settled around $300. The likely scenario is that this is the new floor from which the next price push will take place possibly to settle again between $600 and $900.

Timing a bull run is not a science. We can be sure that BSV will make its' biggest price break when hedge funds are convinced that BSV is the real Bitcoin. This will happen when all the arguments against BSV crumbles one by one and we reach tipping point in public perception first within the crypto community then in the wider public.

With that in mind the start of the next run should happen soon after the Genesis upgrade faultlessly. With that we should see all the apps timing for this event launch on the BSV blockchain. This burst in activity especially in monetized social media apps will pull many within the crypto community towards BSV.

How will it play out?

We should first see a sell-offs in alt as the smart developers and investors realise that their projects will work better on BSV. As before the move will be gradual but we will see it as a match between BCH and BSV.

It is quite surprising that BCH has maintained even the valuation it has now, with such low number of transactions on its' blockchain. Perhaps BCH supporters believe that it is digital silver to BTC'd digital gold. The truth is that with micro-transactions a reality, there is no need for digital silver, bronze or gold for that matter.

So the next phase will be a seesawing battle between BSV and BCH with the BSV whales taking every opportunity to build on their portfolio as the price moves in their favour. I suspect that BCH supporters will fight hard to prop up the value to stay ahead of BSV. If true this behaviour can be taken advantage off.

This phase will complete when BSV move to number 4 on coinmarket ranking indisputably, which will then trigger the next phase which is the race to NO 1.

Tuesday, August 22, 2017

Till Death Do Us Part - The Partening

Sadly, for BTC there are no good outcomes. The Chain Death Spiral has set in and it can only have one ending. The BTC chain will come to a grinding halt, because the little hashing that is left, will not be enough to take it past the next difficulty adjustment, if it makes it past the one coming up.

At the very core,(pun intended) the real difference between BCH and BTC is that people embracing BCH believe in the protocol while people embracing BTC believe in the development team. Because the protocol was held hostage by the development team, this current state of affair arose. Never again should we allow, or even make it possible for any faction, not even miners, hold the protocol hostage.

We are now watching the end game play out. The value of BTC is crumbling. The parties holding the price up will soon give up completely. It is futile, When the chain in question is impossible to use, it does not have a value. Already 38.95% of the hashrate have migrated to BCH and they are never going back, despite wishful assurance that they will, arguably to chase better profits. In reality, for a large majority of miners, the bitter experience of the past have been too painful. In addition it also does not make any sense to be mining on both chains.

A miner now earns 83% less, mining on the BTC chain. In addition he wont be able to cash out for at least 2 days and by then the prices could have fallen further. No commercial miner can absorb these losses for long, no matter how strongly he supports the losing chain. His losses are uncapped, unknown and uncontrollable. Contrast this situation to that of the initial early BCH miner. He could allocate and budget for a cash burn until the project succeeds. His losses are capped, known and controllable.

BTC price may never recover. It will slide downwards with decreasing usability, The BTC chain may never be profitable to mine on again. On the other hand the price of BCH will trend upwards with increasing hashrate migration.

Related Articles

Chain Death Spiral - Watch In Real Time - Here

Will the real Bitcoin Please Stand Up - Here

A Tale Of Two Coins - Here

Bitcoin Cash Will Regain The Mantle To Be Bitcoin - Here

Sunday, August 20, 2017

Chain Death Spiral - Watch It In Real Time

Chain Death Spiral Real Time Monitor

Check above data here ( block time and hash rate )

This graph will show you how much hashrate have migrated to the BCH chain, also in real time. As I write it is approaching 23%

BTC to BCH Hashrate migration

The BCH chain is curently 1125 blocks behind the BTC chain. Click on the link for an update. This next graph will give you the speed at which blocks are being found. If you divide 10 minutes by the speed you get the block time. So 10/3.6 equals 2.77 minutes for BCH and 10/0.87 equals 11.49 minutes for BTC. It will take 1125*2.77/60/24 = 2.16 days to find those 1125 blocks

Block Speed Monitor

At this rate the BCH chain will be longer than the BTC chain by Wednesday. Earlier if the hashrate migration is faster.

Another graph of interest is the difficulty retargeting.

Difficulty Retargeting Monitor

At this point BTC will retarget in 2.49 days. The next difficulty can be seen here. Even when the difficulty adjust it will not be very different from the difficulty now as it is very close to the end of the 2016 blocks readjustment period. The problem for the BTC chain is that it must now keep this difficulty for another 2016 blocks with ever lengthening block times creeping in.

The BCH chain is set to retarget in 2.8 days. This next difficulty adjustment will still be well below that of the BTC chain. By this time the BCH chain is already longer and racing ahead.

In all likelihood if the BTC chain makes it to the next difficulty adjustment, it will never see another difficulty adjustment ever again.

How you process this data and understand the economics of what gives the blockchain value will determine if you make or lose money.

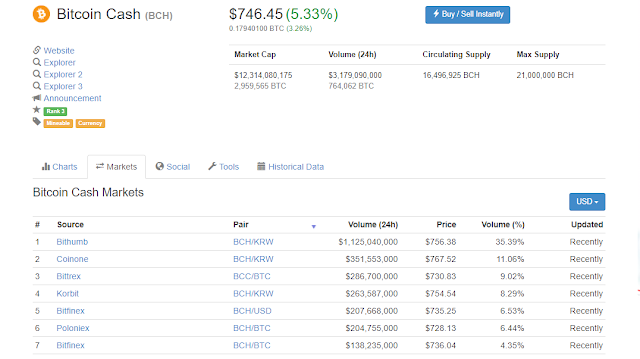

The next link will give you real time price action for Bitcoin Cash. Just look at the fiat exchange pairs as the BTC pairs will become meaningless. The Korean exchanges of Bitthumb, Korbit and Coinone. make up 60% of the market and are in fiat. Outside of Korean exchanges you can follow Bitfinex, Kraken and CEXio. Unfortunately the main exchanges of Gdax, Bitstamp, BTCC and Itbit have ignored Bitcoin Cash.

Conclusion and Possible Outcomes.

BTC price at the moment is unrealistic. Someone is supporting the market at great cost in order to keep the price up as a drop in price will mean that BTC is less profitable to mine leading to more miners migrating. The action is pointless and untenable. Miners will not want to mine a coin that they percieve will lose value by the time they come to sell. The hashrate migration to BCH will not be slowing down either.

So how much is a blockchain that becomes impossible to transact worth? I am afraid the answer must be zero. So these are the possible position and outcomes.

1) Hold BTC and BCH in equal amounts. This is the position you are in if you have not sold your BCH. So Coinbase did their customers a big favor by holding on to their tokens for them.

2) Sell your BTC and buy BCH or any other coin. The time window in which you can do this will shrink very quickly.

3) Buy BCH. Again one where the window of opportunity is closing rapidly. The speed of hashrate migration is the determining factor.

What can anybody do? I am afraid nothing really as we must now let events run its' course. Appealing to miners for support is not what Bitcoin is about. Bitcoin is strong only if the pure economic forces of individual profit is the motivator. Consensus by agreements is unnatural and will not work. The invisible hand of the market must be allowed to function without intervention.

BCH and BTC price will trend lower. How low is unknown but hold. The position will settle and reverse. This period of uncertainty will end and we will learn from it. Bitcoin will continue the journey and we will sail past 5000 again.

These are my opinions and not financial advise so use your own judgement. I have just given you the tools and told you how to use and interpret the result. I hope I am wrong. I pray I am wrong. We are in this position now. If you have another scenario let us hear it. You can't suggest burying you head in the sand!

Segwit would not help much. Very few people would use it. It takes time to gain acceptance and adoption. The same with lightning.

Related Articles

Will the real Bitcoin Please Stand Up - Here

A Tale Of Two Coins - Here

Bitcoin Cash Will Regain The Mantle To Be Bitcoin - Here

Chain Death Spiral - Here

Will The Real Bitcoin Please Stand Up. Please Stand Up.

Tomorrow 21 August 2017 there will be solar eclipse over large swathe of the USA. On this day the Big Blockers and Small Blockers who have been at war for nearly 5 years decided to lay down their keyboards and peace came upon us and the community was once again united.....LOL NOT.

Back to reality

Over the last 3 days the whole of crypto and mainstream media was ablaze with the news of the nearly five fold increase in BCH price to over 1000 USD, sweeping aside all predictions of its' early demise. Of course to those of us who are of the opinion that the BCH fork was a fork back to the original bitcoin, we are not at all surprised. It was rather expected and with the anticipation of more to come, until the Cashening.

Fitting in the pieces

Looking back, we learn that 55% of the trading volume over the last 24 hours amounting to 1.7 Billion USD, yes billion with a "B" was transacted on 3 South Korean exchanges. To put this in context, the total worldwide 24 hour trading volume for BTC was only 2.6 billion. More important was that the 1.7 billion was in fiat. Not BTC. It is clear now that BCH explosive price rise was a result of heavy buying from South Korea with "new money".

So why only South Korea and for BCH? There was no buying pressure from China or Japan. China played a huge part in BTC trade volume until the Chinese government clamp down on the exchanges. The slack was later picked up by Japan when the Japanese Government legalise Bitcoin on 1 April this year. Then on 24 July South Korea made bitcoin payments legal.

South Korea the world's 12 largest GDP and a East Asian Tiger economy made its' mark in the crypto world with a huge play in BCH. South Korea the home of Samsung with 17% share of the world mobile phone market is now officially in the crypto business, and they selected BCH as their vehicle.

This is significant and mark the difference in philosophy and approach by these 3 East Asian economic competitors. China chose to develop their own national digital currency. Japan decided to go with BTC and South Korea have chosen BCH. Who will be right?

Coming back to the 1.7 billion USD 24 hour trade in BCH. This amount of money cannot come from just ordinary citizens. Large institutions and perhaps even banks are involved. This play is not over. Not by a long shot. Expect to see higher and quicker price rises in BCH, especially when the rest of the world catches on to what is really happening.

Will the real Bitcoin please stand up.

Yesterday for the first time it became more profitable to mine BCH than BTC. Today at block 479808 BCH had its' first standard difficulty adjustment and is now only 7% the mining difficulty of BTC. These are watershed moments and marks the point at which miners will choose to mine the more profitable BCH chain, and initiating the dreaded Chain Death Spiral for BTC. So when will BCH replace BTC as the real Bitcoin?

In a Twitter post, Gavin Andresen said that he will refer to BCH as Bitcoin if it has the longest chain and his view is echoed throughout the community. Over the last 24 hours 139 BTC blocks and 263 BCH blocks were found respectively. This is a difference of 124 blocks. As of now the BCH chain is 1452 blocks behind BTC. This means that in as little as 11 days and most probably earlier the BCH chain will overtake the BTC chain to become the longer chain. Will we then call BCH Bitcoin?

Another twist. Ryan Charles in his latest Youtube post suggested that BCH should just be called CASH. Wow. What a great idea. A totally left field proposition and yet on reflection its' simplicity is indeed powerful. BCH is exactly that - CASH - Spending Money.

So now we come back to the question of between China, Japan and South Korea, which country chose correctly. My money is on South Korea. What's yours?

Related Articles

A Tale Of Two Coins - Here

Bitcoin Cash Will Regain The Mantle To Be Bitcoin - Here

Chain Death Spiral - Here

Saturday, August 19, 2017

A tale of Two Coins

That there were delinquent mortgages in a package of securities was not unknown. The idea was that returns from the good mortgages easily covered the small losses from the bad. The problem however was that there was an insatiable appetite for these products and investors were willing to accept ever higher level of risky mortgages in their basket, to the point where these sub-prime mortgages were "manufactured" to supply the demand. Investors drew comfort from the widely held but faulty notion that house prices will keep rising and the property market will never collapse. They were wrong, and we are still living the result of that folly, with nearly 10 years of recession/depression.

How is this relevant to Bitcoin?

In a previous article I pointed out that as a result of Bitcoin Cash, miners now have the option to mine BTC or BCH. Bitcoin without the Emergency Difficulty Adjuster (EDA) is vulnerable to a massive drop in hashing power which would lengthen the time between blocks to hours such as happen to BCH at the time of the fork. This is a disaster that BTC would never recover from because it does not have the protection of EDA.

The Bitcoin mainstream refused to acknowledge this, postulating that it would never happen and that miners will never do that. But that is not the point. The question is not if miners will or won't but if they can or could, and if it is the latter, then there is a non zero existential threat to the universally held notion of the indestructibility of Bitcoin. Investors who hold bitcoins as a store of value can wake up one morning to a black swan event that renders the value of their nest egg to zero. Projects and start-ups dependent on BTC holding value will collapse and fail.

To make matters worse BTC is also limited to 1MB blocks. This means that if only a fraction of mining power is lost to the bitcoin network, block time lengthens and the mempool bloats. Without the benefit of big blocks to clear the backlog, transaction fees increases to the point where the bitcoin blockchain becomes unusable, except to those willing to pay usurious fees.

Long block and block maturity time will drive miners to mine the BCH chain which is already more profitable. This causes a feedback loop which will inevitably lead to the dreaded Chain Death Spiral, and the collapse of the Bitcoin blockchain.

To argue that the BTC blockchain is more profitable to mine if higher fee rewards are taken into account, is oxymoronic to the extreme. It is the argument of a bias and disingenuous supporter or a greater fool. The fees are high precisely because blocks are small. Pinning their hopes on Segwit and/or 2MB is hopelessly inadequate and unrealistic for a technology that is on the cusp of explosive growth and mainstream adoption.

The time for action is now.

We must now confront the reality that Bitcoin has not 1 but 2 fatal flaws. EDA and 1MB blocks. The effects of the 1MB block is already evident with the mempool consistently over 45MB and a blockchain that is becoming increasingly unusable. In all probability, the Bitcoin blockchain is kept alive only by the good graces of miners honoring their increasingly untenable NYA agreement.

Why has there been no discussions of these fundamentally important and critical issues? The answer must be fear and greed. Fear that any such discussions will lead to the fall in the bitcoin price or a move to Bitcoin Cash. However, censoring and avoiding discussions purely out of greed is downright fraudulent. We have already seen what happens as a result of greed replacing reason in the sub-prime disaster. Not to address this "elephant in the room" may lead to a total loss of confidence by the public and ridicule by governments and banks, eager and waiting to regulate and control.

Contrary to popular misconception, Bitcoin Cash is the real bitcoin, and it was not a new fork, but a fork back to the original. In just two weeks it has taken the number three spot in market capitalisation and will soon replace Ethereum at number two. In the process it has eroded the value of all alt coins that have gained prominence because they were allowed to exploit their specific niches by eroding use and value from Bitcoin. The community is sending a message. Loud and Clear.

Related Articles

Bitcoin Cash Will Regain The Mantle To Be Bitcoin - Here

Why is Bitcoin Price Rising - It May Not Be What You Think - Here

Bitcoin Fork - Smoke. Mirrors and a good game of Poker - Here

Chain Death Spiral - Here

Thursday, August 17, 2017

Bitcoin Cash (BCH) Will Regain The Mantle To Be Bitcoin

Here Is Why

BTC BCH TOT BTC BCH BTC BCH BTC

( Hash Power ) ( Difficulty) ( Block Time ) (mempool)

11 August 6600 338 6938 923 115 10.00 21 55

12 August 6199 416 6615 923 115 10.66 20 15

13 August 6808 440 7248 923 115 9.73 18.46 27

14 August 5951 522 6473 923 115 11.07 15.82 47

15 August 6966 647 7591 923 115 9.47 12.85 53

16 August 5984 484 6468 923 115 11.07 17.14 50

- Since 11 August Hash Power on the BCH chain has increased daily.

- Hash power on BTC chain on the other hand fluctuates from day to day, by up to 1000 PH and the mempool continues to grow.

The table above are snapshots taken at a point in time each day. Their individual states can be monitored in real time here*. Scroll down to the hash rate. BTC hash rate is down to 4853 PH. This is more than 2000 PH below the table above and the mempool has now exceeded 65MB. I truly believe that the dreaded Chain Death Spiral has set in but is being "managed".

This large fluctuation of BTC hash rate could be the miners preventing difficulty from adjusting downwards, and at the same time growing the mempool. It is also possible that with over 1000 blocks to the next difficulty recalculation, we may not see another difficulty adjustment on BTC anytime soon.

It is uncanny that we see very little discussion and debate at the very top. It is as though the NYA agreement have settled everything. However make no mistake. What seem calm belies what is happening in the background. Like a duck on the water paddling furiously underneath.

Over at r/bitcoin talk seems to center around price and technology. Nothing about any negativity, usability or the growing mempool. Censorship of robust discussions is just downright deceitful. Especially if it is the de facto forum. It must quit being a propaganda organ. There will be consequences.

Undoubtedly the people around Segwit must be frantically on the phone, fax and email arguing and pleading with the miners. They can see the writing on the wall. Only 124 blocks were found in the last 24 hours. Block time have increased to 11 minutes and the mempool is in excess of 70MB. It is "too little too late". For many of the miners "Revenge is a dish best eaten cold".

Here is why Bitcoin Cash (BCH) Is The Real Bitcoin

It is the original bitcoin

It was hijacked from Gavin Andresen very surreptitiously by Adam Back with his Sidechain proposal. It was a "Trojan Horse" and together with the help of Blockstream, Theymos and the Core developers the process was completed. We the original community have finally regained control of the Bitcoin project, except that we have lost control of the name. This position is about to be redressed.

It does not have Segwit.

If you look at a Bitcoin file as AD. A being the address and D being the data, Segwit removes the address portion A, It is reduced to a hash and the original signature is discarded after it is verified. So if your "fingerprint" is the hash of all your signatures, the signatures are discarded after being checked, and only the "fingerprint" is kept. This is in effect what Segwit does.

The signatures are stored on another chain, but not the main chain. Some nodes will keep signatures, some only keep partial records, some will discard them entirely. If you ever need to refer back to the transaction to check on the signatures all you have is the hash. "The fingerprint". Satoshi's original design of bitcoin being an unbroken record of signatures is violated.

It allows for unlimited on-chain scaling.

A clear example of the disastrous effect of limiting the blocksize is the state of BTC now. The mempool is huge and getting bigger, fees are "over the top". Their intention is to push low fee transactions to side chains and the lightning network. These solutions don't exist yet.

The Core developers bought themselves over 2 years delaying and obfuscating on chain scaling, and yet have no working solutions. Meanwhile the user experience gets so bad that many users have sought other alternatives to transact. BCH in the meantime have mined an 8MB block.

It has more client implementations

BCH will have Bitcoin XT, Bitcoin Classic, Bitcoin Unlimited, Bitcoin ABC and more. Each with their own development team but all operating on the same chain. This diversity increases security, innovation and development of the whole ecosystem.

The part played by nChain in this saga should not be discounted. Without a doubt the most interesting improvements in Bitcoin is coming from nChain. Split Keys, Turing completeness are major developments. Whether you believe Craig Wright is Satoshi or not, there is no doubt he is the brightest and most fertile mind in the Bitcoin space, and he does not support Core and Segwit.

* Unsure of the accuracy of this but can be double checked on Blockchain.info

Related Articles

Why is Bitcoin Price Rising - It May Not Be What You Think - Here

Bitcoin Fork - Smoke. Mirrors and a good game of Poker - Here

Chain Death Spiral - Here

BTC is Dead - Long Live BTC - Here

BTC is Dead - Long Live BTC Updated and Explained ELI5 - Here

Monday, August 14, 2017

Why is Bitcoin Price Rising. The Answer May Not Be What You Think.

Higher prices leading to greater interest and media hype. True.

Large investors and hedge funds investing. Also True.

More people trust the Core developers. Perhaps True.

Segwit is locked in and will activate soon. Maybe True.

But what if the people in control allow it !?

So who are these people in control? They are the people who simply by their action will affect the price. No, not the market manipulators as their desired results are not guaranteed and effect only temporary. No not the developers or even users. I am talking about the people in control of the hashing (mining) power, and by their action supporting or withdrawing their hashing, affects the success or failure of a chain.

For the first time in Bitcoin history. if the miners withdraw their mining power from mining BTC, transactions on the BTC chain will grind to a halt. ( See Chain Death Spiral ) Block confirmation time will be exceeding long and user experience so bad that BTC's price will collapse. Just the announcement that they will do so is enough to affect the price negatively.

So why have they not done so before? Well, prior to the fork, they will only hurt themselves as they mine and hold BTC. Today they have another option. When this strategy plays out, their plan will make them all the money that they have dreamed about.

Some of the miners with about 40 percent of the mining power have fought a very bitter battle for big blocks over several years. It was a very nasty, very open spat with both sides spewing verbal diarrhea on social media. This will not be settled by just a simple agreement and bear in mind that none of the Core developers were present or signed the NYA agreement.

We hear justifications like :

- Miners mine the most profitable coin. True, but this is economic action not strategy.

- Miners will honor their agreement. Money talks. Everything else is just noise.

- Segwit and BTC is better technology. Better technology does not always win.

Core developers are not the same as the army of programmers and developers pulling for Segwit and Side chains and Lightning. I cannot fault their passion, zeal and dedication. However they are just being used to push an agenda.

Core developers do not want Segwit2X and have openly said so even coding to exclude Segwit2X transactions. They did not expect the BCH fork, but even so, are perfectly happy with BTC as it is, even if it loses to the other chain. There will be no Segwit2X. Simply put there are no developers for Segwit2X. Core developers will not be coding for Segwit2X.

The Big Reveal.

This is the Rich List as at 13 August 2017. The numbers may not be 100% accurate but they do paint an unmistakable picture.

BTC BCH BTC BCH

10000 - 1000000 121 121 3011886 3310777 +298891

1000 - 10000 1666 1688 +22 3544974 3635319 - 90345

100 - 1000 16594 16160 -434 3840815 3726874 -113941

10 - 100 129880 122874 -7006 4344270 4183607 -160663

1 - 10 464743 424298 -40445 1277766 1163236 -114530

Most of the BCH coins about 300K have been gobbled up by the top bracket of 121 addresses. If BCH and BTC flips at current valuation, it will mean a windfall of just over 1 Billion dollars now. When this finally plays out, it will make the "Big Short" look like a pauper's picnic.

All the rhetoric encouraging BTC owners to sell their BCH for BTC, and media hype pushing up BTC price helps their strategy, without them lifting a finger. All that is left to do is switch the chain when they are right and ready. Don't get caught on the losing side.

P/S Please share. Help your fellow bitcoiners get the best information before they make the investment of their future. Fear Of Missing Out especially now can lead to unwitting mistakes and losses.

Update 15 August 2017

BTC BCH TOT BTC BCH BTC BCH BTC

( Hash Power ) ( Difficulty) ( Block Time ) (mempool)

31 July 6163 860

1 August 6440 1525 7965 860 860 9.66 160 5

2 August 6433 378 860 860 9.47 205 5

3 August 5931 447 860 860 10.43 41 10

4 August 7749 216 7965 860 225 8.04 75 23

5 August 7473 143 7617 860 225 8.13 110 5

6 August 6023 499 6612 860 114 10.28 22 3

7 August 6637 551 7188 860 114 9.41 18 33

8 August 6835 154 6989 923 115 8.78 62 35

9 August 6200 541 6741 923 115 10.43 15 43

10 August 6165 576 6741 923 115 10.74 14 42

11 August 6600 338 6938 923 115 10.00 21 55

12 August 6199 416 6615 923 115 10.66 20 15

13 August 6808 440 7248 923 115 9.73 18.46 27

14 August 5951 522 6473 923 115 11.07 15.82 47

Floating 1492

14 August - Hash Power on BTC reduced to 5951 PH and increased on BCH to 522 PH. The BTC chain is starting to slow, with mempool at 47MB and Blocktime 11.07 minutes. It will be interesting to see if the hash power increases tomorrow.

The amount of 1492 PH in red is the difference (7965 - 6473) between the highest recorded and today. That amount of hash power exist but is not on the network. Somebody controls it. Watch what they do with it. BCH price is rising (0.072) as the BCT chain gets slower. Let us watch as BCH retake its' position as the Real Bitcoin. More To Come. Keep Sharing.

Thursday, August 10, 2017

Chain Death Spiral - A Fatal Bitcoin Vulnerability

However on the 1st August 2017, Bitcoin main chain forked and a new coin Bitcoin Cash (BCH) came into existence. Some argue that it is closer to Satoshi's vision than the current Bitcoin (BTC) which separate the data portion from the address portion of the data structure. BTC became the main coin because it was supported by the majority of users, developers, Bitcoin businesses and miners in what is now knows as the New York Agreement.

Chain Death Spiral. (CDS)

After Bitcoin fork on 1 August it became obvious that Bitcoin the protocol did have an inherent vulnerability. This was that if the chain loses mining power it will have to wait a full 2016 blocks before the difficulty can be adjusted to bring the block time back to the normal 10 minutes. This vulnerability was never considered or analysed because until now the miners had no choice but to keep mining on the Bitcoin chain. After the fork however, the whole landscape has changed. Miners have a choice and power to influence the fate of the chain they are mining on.

This was brought clearly into focus when the blocktime of the BCH fork went as high as 15 hours per block in the beginning. BCH however was designed with Emergency Difficulty Adjustment (EDA) which adjusted the difficulty even before the 2016 block adjustment period is up. Bitcoin (BTC) does not have this safety feature and cannot have one unless a hardfork is performed to include it.

A Chain Death Spiral occurs when the block time increases leading to some miners switching chain. As more miners leave the problem gets worse and a feedback loop results in the dreaded Chain Death Spiral.

Bitcoin (BTC) mempool been increasing since after the fork on 1st August. It is currently 52MB which means it will take 52 blocks to clear without any additional transactions. The record was in May 2017 when it reached 120MB. The whole community was in an uproar resulting in a move towards other competing coins for transacting.

Looking at the hashrate distribution and starting from the 6th August we get the following

(Peta Hash) BTC BCH TOTAL (Block Time) BTC BCH

6 August 2017 7473 143 7617 8.13 110

7 August 2017 6023 499 6612 10.28 22.15

8 August 2017 6637 551 7188 9.41 18.46

9 August 2017 6835 154 6989 8.78 62

10 August 2017 6200 541 6741 10.43 15

A picture is forming. Between 8 to 10 August roughly 400 petahashes moved out of BCH which triggered the EDA adjustments then move back in. In addition there was a loss of 200 Peta Hashes on the 9th August and a further 200 Peta Hashes loss on the 10th August.

The current BTC mempool is 50MB and blocktime is 10.28 minutes. There is clearly a development and it will get clearer today. Will the 400 Peta Hashes leave BCH again or will the hashing power on BTC decrease further. What happened to the 400 Peta Hashes missing since 8th August. The BTC chain cannot afford further loss of hashing power. Its' blocktime must come back to within 10 minutes and soon.

What is certain is that the current price of BTC is not justified with this inherent vulnerability, risk of the dreaded Chain Death Spiral. Have investors totally abandoned any thought of immutable economic security and due diligence? It is incredible how we lose sight of the risks when we bamboozled with riches, hype and misinformation through censorship.

It is other peoples' hard earned money and other peoples' investments. Even the possibility that this "black swan event" can happen must be addressed. It should never be censored speech.

Related Articles

BTC is Dead - Long Live BTC - Here

BTC is Dead - Long Live BTC Updated and Explained ELI5 - Here

Why is Bitcoin Price Rising - It May Not Be What You Think - Here

Bitcoin Fork - Smoke. Mirrors and a good game of Poker - Here

Bitcoin Cash Will regain the mantle to be Bitcoin - Here

Intelligent Comments

(1) Mining rewards can only be spent after 100 blocks. Normally that's about 17 hours. If 90% of mining power disappeared that would take a week. So that's a strong incentive to mine something else (if available) in itself.

(2) Bitcoin economy grinds to a halt, as transactions become increasingly impossible. This leads many people with coins on exchanges to buy other coins just to be able to transact, which lowers the price, making the alternative chain even more attractive for miners.