When will Bitcoin SV next bull run take place?

Guess we are all still buzzing over the last BSV price run up! When the dust finally settled BSV is up 300% and holding. So why did the last price hop happened? The main excuse was that CSW got the keys to his bitcoins! I commented then that it is nonsense as it was only a rumour and even if true the impact will be negligible. If the fear was that he would dump BTC to push up BSV then BTC should have experience a significant drop in price.

Those who are into BSV know that it is the original and real Bitcoin and are convince that it will be the only blockchain on which all blockchain apps will be built. The run up in price is only the first phase of existing whales and hedge funds building a position and new money coming into BSV.

Had it just been a CSW rumour then BSV's price would have drop lower than from where it started - about $90. Instead it has settled around $300. The likely scenario is that this is the new floor from which the next price push will take place possibly to settle again between $600 and $900.

Timing a bull run is not a science. We can be sure that BSV will make its' biggest price break when hedge funds are convinced that BSV is the real Bitcoin. This will happen when all the arguments against BSV crumbles one by one and we reach tipping point in public perception first within the crypto community then in the wider public.

With that in mind the start of the next run should happen soon after the Genesis upgrade faultlessly. With that we should see all the apps timing for this event launch on the BSV blockchain. This burst in activity especially in monetized social media apps will pull many within the crypto community towards BSV.

How will it play out?

We should first see a sell-offs in alt as the smart developers and investors realise that their projects will work better on BSV. As before the move will be gradual but we will see it as a match between BCH and BSV.

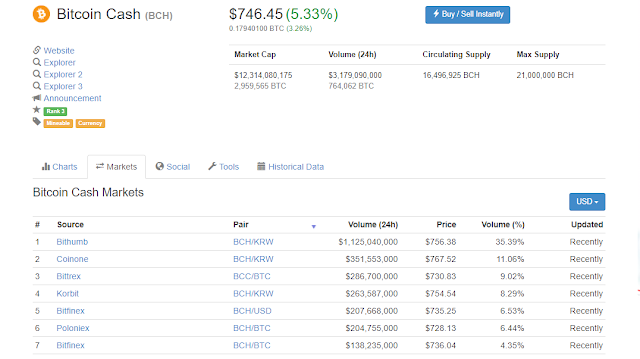

It is quite surprising that BCH has maintained even the valuation it has now, with such low number of transactions on its' blockchain. Perhaps BCH supporters believe that it is digital silver to BTC'd digital gold. The truth is that with micro-transactions a reality, there is no need for digital silver, bronze or gold for that matter.

So the next phase will be a seesawing battle between BSV and BCH with the BSV whales taking every opportunity to build on their portfolio as the price moves in their favour. I suspect that BCH supporters will fight hard to prop up the value to stay ahead of BSV. If true this behaviour can be taken advantage off.

This phase will complete when BSV move to number 4 on coinmarket ranking indisputably, which will then trigger the next phase which is the race to NO 1.

Guess we are all still buzzing over the last BSV price run up! When the dust finally settled BSV is up 300% and holding. So why did the last price hop happened? The main excuse was that CSW got the keys to his bitcoins! I commented then that it is nonsense as it was only a rumour and even if true the impact will be negligible. If the fear was that he would dump BTC to push up BSV then BTC should have experience a significant drop in price.

Those who are into BSV know that it is the original and real Bitcoin and are convince that it will be the only blockchain on which all blockchain apps will be built. The run up in price is only the first phase of existing whales and hedge funds building a position and new money coming into BSV.

Had it just been a CSW rumour then BSV's price would have drop lower than from where it started - about $90. Instead it has settled around $300. The likely scenario is that this is the new floor from which the next price push will take place possibly to settle again between $600 and $900.

Timing a bull run is not a science. We can be sure that BSV will make its' biggest price break when hedge funds are convinced that BSV is the real Bitcoin. This will happen when all the arguments against BSV crumbles one by one and we reach tipping point in public perception first within the crypto community then in the wider public.

With that in mind the start of the next run should happen soon after the Genesis upgrade faultlessly. With that we should see all the apps timing for this event launch on the BSV blockchain. This burst in activity especially in monetized social media apps will pull many within the crypto community towards BSV.

How will it play out?

We should first see a sell-offs in alt as the smart developers and investors realise that their projects will work better on BSV. As before the move will be gradual but we will see it as a match between BCH and BSV.

It is quite surprising that BCH has maintained even the valuation it has now, with such low number of transactions on its' blockchain. Perhaps BCH supporters believe that it is digital silver to BTC'd digital gold. The truth is that with micro-transactions a reality, there is no need for digital silver, bronze or gold for that matter.

So the next phase will be a seesawing battle between BSV and BCH with the BSV whales taking every opportunity to build on their portfolio as the price moves in their favour. I suspect that BCH supporters will fight hard to prop up the value to stay ahead of BSV. If true this behaviour can be taken advantage off.

This phase will complete when BSV move to number 4 on coinmarket ranking indisputably, which will then trigger the next phase which is the race to NO 1.