23 May 2017, Barry Silbert, CEO of Digital Currency Group successfully led a consortium of business leaders, to ratify the Hong Kong agreement. This Segwit2X proposal, moved the scaling issue forward.

The first Segwit2X block will be produced around November 16 and miners will start mining on top of this block. This will inevitably kicking off the next Bitcoin hard fork round with even more drama than the last. The scramble for hashrate will be between Bitcoin Cash, Segwit2X ans Segwit1X.

Segwit2X has 95% miners support, and should be "The Bicoin" after the fork at block 494784. Since f2pool will support Segwit1X, it will at least have15% mining support. However successfully forking a Bitcoin chain is very difficult. It has to survive the Chain Death Spiral and make it to the next 2016 blocks difficulty adjustment. In all probability Segwit1X may hardfork away, if Core can't persuade miners to abandon Segwit2X.

Core supporters know this and so, from now until 16 November they will be campaigning hard against Segwit2x. The latest release of Core 0.15 nodes does not recognise nodes running btc1. This does not achieve much because just 2 btc1 nodes will be enough for the chain to propagate. This is a "life and death" struggle for control of the main Github repository. If Segwit2X wins it will be BTC1 and if Segwit1X wins it will be Core.

Segwit (1X or 2X) and Bitcoin Cash - The Next Battle

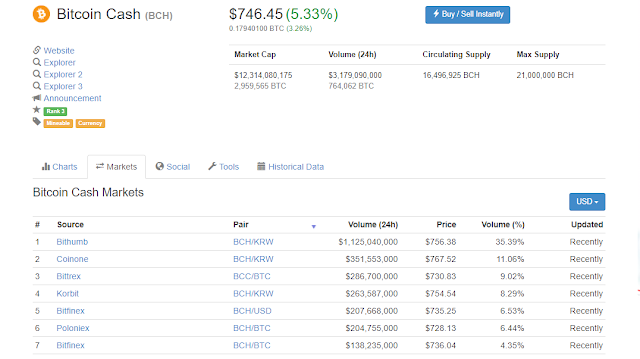

The final battle for the Bitcoin brand will be between Bitcoin Cash and Bitcoin Segwit. This issue will be settled over which protocol has the better scaling solution.

Currently the BTC blockchain can handle just under 300,000 transactions a day. In the long run, demand for blockspace is infinite, held back only by transaction fees. Bitcoin Cash and Segwit have different approaches on how to find the ideal fee equilibrium.

Bitcoin Cash approach is for an unlimited blocksize allowing for free and low fee transactions. The approach is to allow any amount of on chain scaling now while waiting for other scaling technologies to develop and mature with demand and adoption. It is important to realise that Bitcoin Cash does not exclude second layer solutions.

Segwit on the other hand, caps the blocksize and, aims to push users towards second layer solutions immediately, with the objective of molding the BTC blockchain into a settlement layer. Second layer solutions are not yet ready for deployment and even when deployed, there will be a steep learning and adoption curve to overcome. This approach is "putting the cart before the horse".

Maximising Transactions Fee Revenue

Whether a transaction is on-chain or off-chain, it is a Bitcoin transaction. If that transaction takes place off-chain, then the fee paid to the off-chain processor is fees that would have otherwise gone to the miner. The more off-chain transactions there are, the less the miners would have earned. This is where the short term and long term scenarios of the two chains diverge.

The chain that is more useful will have more transactions, and so provide miners with the most profit. This is important in a system where the coinbase reward will be decreasing over time to be replaced by fee revenue.

Maximisation of miners revenue is key. In the short term while transaction volumes are low, Segwit wins with higher fees, but long term as transaction volume grows 100X or even 1000X the fee advantage moves to Bitcoin Cash.

- "The Bitcoin" is just the chain that the industry selects. It is not "the longest chain" as BCH is the longer chain. It may not even be "the most work done". It will be "The BTC" that trades on the exchanges.

- If Segwit2X hardforks and wins, it will be "The Bitcoin". Core will no longer be the main Github repository. It will be btc1.

- Most transactions are single payments. To use Lightning you must first send some Btc to the channel. This must be more expensive and complicated for simple payments eg. coffee.

- Micro payments channels will generate huge amounts of transactions but they will not add to miners revenue.

- Many projects left or were shelved when transaction fees escalated. How many of these projects will return to build on Bitcoin Cash is still to be seen? Yours was one. Another old favorite Satoshi Dice.

- Maximising transaction revenue is key to winning the long game and become "The Bitcoin". On this premise Bitcoin Cash has the advantage in the long run.

- Segwit addresses are also confusing to users and even more so for newbies. There are 4 possible Segwit address types.

- Segwit supporters cannot understand why miners would mine BCH if it is less profitable. Current profitability calculations is based on price at time of mining. Miners may have a different time frame to base prices. If their thinking is for BCH to replace BTC then future returns would be astronomical.

Till Death Do Us Part - The Partening - Here

Chain Death Spiral - Watch In Real Time - Here

Will the real Bitcoin Please Stand Up - Here

A Tale Of Two Coins - Here

Bitcoin Cash Will Regain The Mantle To Be Bitcoin - Here

Chain Death Spiral - Here