As I write this we are just a day past the BSV halving, two days past BCH halving, and another 30 days before BTC halving.

A note on crypto prices

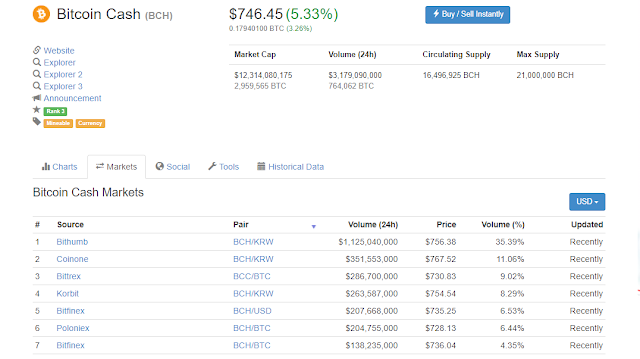

Price changes in alts follows the price of BTC because alts are mainly paired against BTC on almost all exchanges. This will remain the case unless we can decouple from BTC.

One way that this can happen is to pair against Tether (USDT). As of today it has a marketcap of 6.5 billion, an increase of about 2.5 billion recently. However Tether will need a much higher marketcap in order to replace BTC.

Another is if a clear winner to emerge out of the BTC, BCH and BSV hash war.

Mining Economics

For the next 30 days most miners will mine the BTC chain. BCH and BSV chains will revert to their foundation miners Btc.com for BCH and Coingeek for BSV.

Mining at a loss, hodling and waiting for the price to rise.

If the halving of BCH and BSV is any guide, BTC. will most likely maintain price prices on a bearish tone. This means that BTC mining will also be unprofitable.

It is unlikely that miners will continue to mine at a loss. Less efficient miners will have to leave until the difficulty adjusts for mining to be profitable again.

Some miners may decide to mine and hold until the price increases, but this is a risky proposition.

For BTC the Chain Death Spiral also threatens like "Democleas Sword". BTC will be at maximum difficulty after halving, A huge drop in hashrate could trigger it.

Mining dynamics after BTC halving.

Opportunistic mining - On BCH and BTC difficulty is adjusted every block. Some miners will wait until the difficulty adjust low enough before they start mining on the chain. This is more noticeable on the BCH chain.

Price hodling - Miners leaving the BTC chain may choose to mine on BCH or BSV as the chance of these coins doubling will be higher because of it's lower prices.

Pick a winner - This will be hard to predict.

Transaction fee model - BSV wins as it is the only blockchain designed for this.

It is all about transactions

Bitcoin was designed for mining revenue to transition over to transaction fees. The halving in block subsidy was designed to incentivise this. It is incomprehensible how BTC supporters can ignore this simple reality? In the graph above we can clearly see that Fee percentage in blocks between BCH and BSV have diverge considerably after the halving. This trend will continue. BSV will continue to increase the number of transactions per block because it is designed for users to write data to the blocchain.

The major transaction volume on BSV are users writing weather data ( weathersv) and exchange data (preev) to the blockchain. However on the horizon are real enterprise users in supply chain management (unisot) (kowr) and medical data (EHR).

A new model for miners as transaction processors.

There will be a paradigm change. Miners need security of income in order to justify spending millions in hard and soft infrastructure. They will become transaction processors.

They will be able to contract with large enterprise users exclusively to process their transactions thus guaranteeing a reliable income stream. Such contracts will be hard to disrupt as a bond of trust will develop between the parties. It will also incentivise the miner to improve their service in order to keep their customers.

Buy the dip sell the top

For BSV supporters, an opportunity exist to buy the dip and sell the top until BTC halving because it will be volatile. Risky, but if you can time it right, there is an opportunity to multiply your holdings. Use wallets like Exodus, Coinomi and move between BSV and USDT. Warning - It is risky and very difficult to time the bottom and the top and too easy to get emotionally involved. Only risk what you can afford to lose. Remember most people "can pick it but cannot time it".

BSV flipped BCH in January but could not maintain the lead. In all likelihood BSV will again flip BCH before BTC halving. If this happens look for BSV to moon and win the hash wars as miners chase profits.

Price changes in alts follows the price of BTC because alts are mainly paired against BTC on almost all exchanges. This will remain the case unless we can decouple from BTC.

One way that this can happen is to pair against Tether (USDT). As of today it has a marketcap of 6.5 billion, an increase of about 2.5 billion recently. However Tether will need a much higher marketcap in order to replace BTC.

Another is if a clear winner to emerge out of the BTC, BCH and BSV hash war.

Mining Economics

For the next 30 days most miners will mine the BTC chain. BCH and BSV chains will revert to their foundation miners Btc.com for BCH and Coingeek for BSV.

Mining at a loss, hodling and waiting for the price to rise.

If the halving of BCH and BSV is any guide, BTC. will most likely maintain price prices on a bearish tone. This means that BTC mining will also be unprofitable.

It is unlikely that miners will continue to mine at a loss. Less efficient miners will have to leave until the difficulty adjusts for mining to be profitable again.

Some miners may decide to mine and hold until the price increases, but this is a risky proposition.

For BTC the Chain Death Spiral also threatens like "Democleas Sword". BTC will be at maximum difficulty after halving, A huge drop in hashrate could trigger it.

Mining dynamics after BTC halving.

Opportunistic mining - On BCH and BTC difficulty is adjusted every block. Some miners will wait until the difficulty adjust low enough before they start mining on the chain. This is more noticeable on the BCH chain.

Price hodling - Miners leaving the BTC chain may choose to mine on BCH or BSV as the chance of these coins doubling will be higher because of it's lower prices.

Pick a winner - This will be hard to predict.

Transaction fee model - BSV wins as it is the only blockchain designed for this.

It is all about transactions

Bitcoin was designed for mining revenue to transition over to transaction fees. The halving in block subsidy was designed to incentivise this. It is incomprehensible how BTC supporters can ignore this simple reality? In the graph above we can clearly see that Fee percentage in blocks between BCH and BSV have diverge considerably after the halving. This trend will continue. BSV will continue to increase the number of transactions per block because it is designed for users to write data to the blocchain.

The major transaction volume on BSV are users writing weather data ( weathersv) and exchange data (preev) to the blockchain. However on the horizon are real enterprise users in supply chain management (unisot) (kowr) and medical data (EHR).

A new model for miners as transaction processors.

There will be a paradigm change. Miners need security of income in order to justify spending millions in hard and soft infrastructure. They will become transaction processors.

They will be able to contract with large enterprise users exclusively to process their transactions thus guaranteeing a reliable income stream. Such contracts will be hard to disrupt as a bond of trust will develop between the parties. It will also incentivise the miner to improve their service in order to keep their customers.

Buy the dip sell the top

For BSV supporters, an opportunity exist to buy the dip and sell the top until BTC halving because it will be volatile. Risky, but if you can time it right, there is an opportunity to multiply your holdings. Use wallets like Exodus, Coinomi and move between BSV and USDT. Warning - It is risky and very difficult to time the bottom and the top and too easy to get emotionally involved. Only risk what you can afford to lose. Remember most people "can pick it but cannot time it".

BSV flipped BCH in January but could not maintain the lead. In all likelihood BSV will again flip BCH before BTC halving. If this happens look for BSV to moon and win the hash wars as miners chase profits.