Update 6/7/2017

A new presentation by Craig Wright at Future Of Bitcoin conference skip to 2 : 22 : 50

https://www.youtube.com/watch?v=YAcOnvOVquo

Smart Contract on bitcoin presentation https://www.youtube.com/watch?v=KKrQ0lnj-60&feature=youtu.be&t=625

This video first connects Dr Craig Wright to Bitcoin.

I wrote this several months ago but was reluctant to publish it, mainly because many people have poured skeptism about his qualifications on which I have no way of checking. Today (1/4/2016) I read that Mr Wright will be starting the procedures to prove that he is indeed Satoshi. I look forward to this with the hope that we can be lead on the right path towards a bright Bitcoin future. The world needs Bitcoin.

When did you first hear about Bitcoin? (2.20 )

Look at all the replies from people like Gavin, Andreas, Nick, Greg, Amir, Hal - they all point to a date where they read or heard about bitcoin dismiss it then took a second look and their whole world changed.

This is different "I have been involved in this for a long time" His body language and reply could be from someone who actually is - the inventor of bitcoin.

He Need to be highly qualified and knowledgeable in many fields

(1.13) Academic, 2 Masters, 2 Doctorates, works in designing protocols, "part economist, part scientist". He does not seek the limelight, perhaps even uncomfortable with it. Humble inspite of his achievements.

Some have disputed his qualifications . These are references that can be checked. To date his masters qualifications have checked out but not his Phds.

His primary source of income is that of an academic and computer security consultant. He understands cryptography.

Qualifications or lack of it is no indication of ability. If we ask whether he has the technical expertise and broad range of knowledge to design bitcoin, I would say the answer is YES.

Bitcoin is a protocol. He designs protocols.

Bitcoin Mining From Bitcoin's Inception

Are you a miner ? " A long time ago " He pause and considered his reply before answering.

A busy academic with his credentials will not be an avid miner, They might dabble a little like the rest out of curiosity, then put it away because his computer go too hot, as they were worth nothing back then, unless, IT IS HIS OWN INVENTION.

By his actions, purchasing gold from Mr Ferrier with bitcoins, proves that he has quite a large cache of bitcoins which he can only get from early mining. There is leaked documents of a trust created in his favour for 1,1 million bitcoins locked until 1 January 2020. If true this is the amout Satoshi is suspected to control.

If anything will prove that he is Satoshi it will be proving control of this cache of bitcoin.

Financial

As a businessman he was not very successful. This is not unusual as people with high interlect are not suited to the mundane and daily grind of a self start businesses. They are easily distracted.

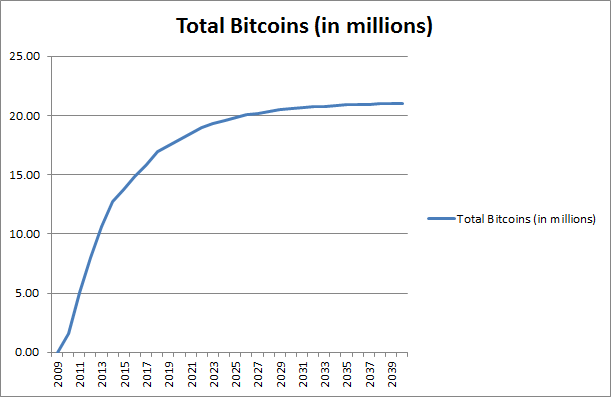

If he was Satoshi and he was mining up to the time when he handed the reins over to Gavin in September 2012 he would have amassed over a million coins. They were of course worth nothing but over the course of the next year and a half everything changed.

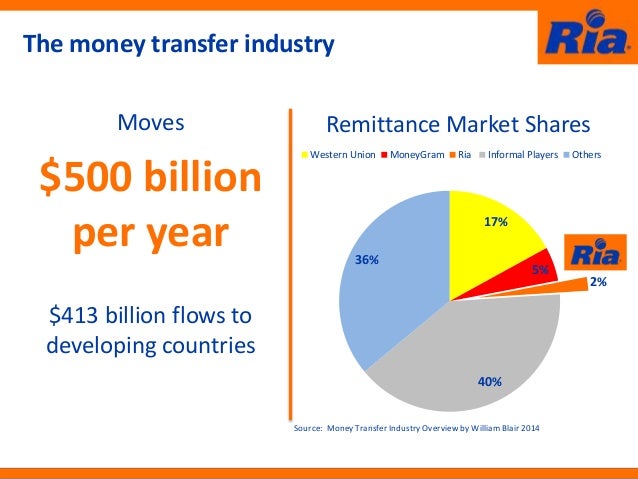

His attempt to purchase gold from Mr Ferrier for 85 million and subsequent lawsuit to claim damages prove that he actually had the bitcoins in question. In May 2013 the price was about $600 but the market was volatile and it woulld have been difficult to convert $85 million in bitcoins.

Perhaps the 30,000 coins put up for sale by "the bearwhale" was from himself.

Watch this video on a more formal look at the man.

Interview The Bitcoin Doco

This is a quote from the video which open an insight to the character and philosophy of the person.

"One of the most fundamental rights of being human is the ability to own and trade property. Every other thing that we do, other than trade, is done by animals, plants, or combinations of the above. There are tool building animals, there are all sorts of things. But what we do that is really unique is we trade. To do that fairly needs property. We need to be able to control our own freedoms and the only way to do that is to basically have the right to property, to ownership, to transfer -- to decide what we want to do. That also means not telling people what we have. If we don't want to go out there and say I am a billionaire or I am running xyz or this is my life... I shouldn't have to tell people that. I should have the right to live frugally if I want to and to invest in business without telling people I am a billionaire... or that I am whatever -- like some people have to these days because governments try to make us. We should be able to choose how we live and that is the fundamental right of property. That means being able to dispose of property as we want; to be able to share it, to take it -- and that is what it is all about. Once we get things to where we have redeemable contracts and we link them to the blockchain. Where we can link money, and goods, digital rights and ownership into something that can't be changed. A fundamental open, honest, truthful asset -- the blockchain. That's when we are going to see real freedom in the world." -Dr. Craig Wright (48:18 - 50:01) Whether he is Satoshi or not, he is certainly a very passionate and extremely intelligent man.