There is nothing more powerful than an idea whose time have come. Blockchain technology will completely change how we organise and use data for the betterment of societies. However only one blockchain will emerge as the underlying protocol and this will be Bitcoin SV.

Sunday, January 17, 2016

Thursday, January 14, 2016

What To Make Of Wences Joining Paypal?

There is a mammoth struggle to be the Goldman Sacs of the new Fintech sector. Coinbase looks like it would have won the race after Bitpay floundered. Today it operates bitcoin on/off ramps in 32 countries.

With Paypal's announcement, the fog around paypal's intentions with bitcoin has solidified. Not only is Wences a driving ambassador in the bitcoin space, he also brings with him Xapo which when combined with Paypal's banking and remittances operations in 160 countries, will allow it to claim top spot.

You can now link Xapo's debit card to your Paypal account, meaning that you can already spend your bitcoins with Paypal to make payments. Accepting bitcoin as a currency on it's platform is not far off.

The legacy banks are staff with people with legacy banking mindsets and will always be feuding internally with the new incumbents coming in with R3. There will be lots of fear and very little co-operation. These people will fight to go down with the ship. None will be players in the new Fintech in any recognisable form.

Coinbase or Paypal. There is more to come in the battle for market share, looks like Bitpay will be specialising in B to B.

The space is still open for a main player to bank the unbanked. Could it be Bitpesa? It certainly needs a company with SMS banking technology.

With Paypal's announcement, the fog around paypal's intentions with bitcoin has solidified. Not only is Wences a driving ambassador in the bitcoin space, he also brings with him Xapo which when combined with Paypal's banking and remittances operations in 160 countries, will allow it to claim top spot.

You can now link Xapo's debit card to your Paypal account, meaning that you can already spend your bitcoins with Paypal to make payments. Accepting bitcoin as a currency on it's platform is not far off.

The legacy banks are staff with people with legacy banking mindsets and will always be feuding internally with the new incumbents coming in with R3. There will be lots of fear and very little co-operation. These people will fight to go down with the ship. None will be players in the new Fintech in any recognisable form.

Coinbase or Paypal. There is more to come in the battle for market share, looks like Bitpay will be specialising in B to B.

The space is still open for a main player to bank the unbanked. Could it be Bitpesa? It certainly needs a company with SMS banking technology.

Thursday, December 31, 2015

Who Is Bitcoin - Dr Craig Wright Could Be Satoshi Nakamoto

Update 6/7/2017

A new presentation by Craig Wright at Future Of Bitcoin conference skip to 2 : 22 : 50

https://www.youtube.com/watch?v=YAcOnvOVquo

Smart Contract on bitcoin presentation https://www.youtube.com/watch?v=KKrQ0lnj-60&feature=youtu.be&t=625

This video first connects Dr Craig Wright to Bitcoin.

I wrote this several months ago but was reluctant to publish it, mainly because many people have poured skeptism about his qualifications on which I have no way of checking. Today (1/4/2016) I read that Mr Wright will be starting the procedures to prove that he is indeed Satoshi. I look forward to this with the hope that we can be lead on the right path towards a bright Bitcoin future. The world needs Bitcoin.

When did you first hear about Bitcoin? (2.20 )

Look at all the replies from people like Gavin, Andreas, Nick, Greg, Amir, Hal - they all point to a date where they read or heard about bitcoin dismiss it then took a second look and their whole world changed.

This is different "I have been involved in this for a long time" His body language and reply could be from someone who actually is - the inventor of bitcoin.

He Need to be highly qualified and knowledgeable in many fields

(1.13) Academic, 2 Masters, 2 Doctorates, works in designing protocols, "part economist, part scientist". He does not seek the limelight, perhaps even uncomfortable with it. Humble inspite of his achievements.

Some have disputed his qualifications . These are references that can be checked. To date his masters qualifications have checked out but not his Phds.

His primary source of income is that of an academic and computer security consultant. He understands cryptography.

Qualifications or lack of it is no indication of ability. If we ask whether he has the technical expertise and broad range of knowledge to design bitcoin, I would say the answer is YES.

Bitcoin is a protocol. He designs protocols.

Bitcoin Mining From Bitcoin's Inception

Are you a miner ? " A long time ago " He pause and considered his reply before answering.

A busy academic with his credentials will not be an avid miner, They might dabble a little like the rest out of curiosity, then put it away because his computer go too hot, as they were worth nothing back then, unless, IT IS HIS OWN INVENTION.

By his actions, purchasing gold from Mr Ferrier with bitcoins, proves that he has quite a large cache of bitcoins which he can only get from early mining. There is leaked documents of a trust created in his favour for 1,1 million bitcoins locked until 1 January 2020. If true this is the amout Satoshi is suspected to control.

If anything will prove that he is Satoshi it will be proving control of this cache of bitcoin.

Financial

As a businessman he was not very successful. This is not unusual as people with high interlect are not suited to the mundane and daily grind of a self start businesses. They are easily distracted.

If he was Satoshi and he was mining up to the time when he handed the reins over to Gavin in September 2012 he would have amassed over a million coins. They were of course worth nothing but over the course of the next year and a half everything changed.

His attempt to purchase gold from Mr Ferrier for 85 million and subsequent lawsuit to claim damages prove that he actually had the bitcoins in question. In May 2013 the price was about $600 but the market was volatile and it woulld have been difficult to convert $85 million in bitcoins.

Perhaps the 30,000 coins put up for sale by "the bearwhale" was from himself.

Watch this video on a more formal look at the man.

Interview The Bitcoin Doco

This is a quote from the video which open an insight to the character and philosophy of the person.

"One of the most fundamental rights of being human is the ability to own and trade property. Every other thing that we do, other than trade, is done by animals, plants, or combinations of the above. There are tool building animals, there are all sorts of things. But what we do that is really unique is we trade. To do that fairly needs property. We need to be able to control our own freedoms and the only way to do that is to basically have the right to property, to ownership, to transfer -- to decide what we want to do. That also means not telling people what we have. If we don't want to go out there and say I am a billionaire or I am running xyz or this is my life... I shouldn't have to tell people that. I should have the right to live frugally if I want to and to invest in business without telling people I am a billionaire... or that I am whatever -- like some people have to these days because governments try to make us. We should be able to choose how we live and that is the fundamental right of property. That means being able to dispose of property as we want; to be able to share it, to take it -- and that is what it is all about. Once we get things to where we have redeemable contracts and we link them to the blockchain. Where we can link money, and goods, digital rights and ownership into something that can't be changed. A fundamental open, honest, truthful asset -- the blockchain. That's when we are going to see real freedom in the world." -Dr. Craig Wright (48:18 - 50:01) Whether he is Satoshi or not, he is certainly a very passionate and extremely intelligent man.

Tuesday, December 8, 2015

Free Bitcoins - Bitcoin Faucets

Yes there are ways to get free bitcoins on the internet. The amounts are small but they are a great way to get new people introduced to bitcoin. These faucets giveaway values may seem small now but years from now when 1 bitcoin is worth $1 million it will seem incredible that anyone would be giving away that much money.

Think that is still ridiculous? Well Gavin Andresen was giving away up to 5 BTC in 2010. Back then it was worth only cents but close to $2000 today.

These links are safe to click and sites are safe to visit.

Links - Freebits

If you have time to spare try these links Freebits Try not to think of them as cents but satoshis. Their value years from now will be much greater

1) Bitpurge

To use this faucet you need to input your bitcoin address. Advisable to use a new address that is not your main bitcoin wallet. My recommendation is Kryptokit because it sits on your browser bar for easy access.

The faucet gives you 800 satoshis every 8 minutes and you can transfer it to your account balance after solving a captcha. When your balance reaches 10000 satoshis you can transfer it to your bitcoin wallet.

Does not mean that they will pay out!!

2) Zapchain

This is not truly a faucet. Zapchain is a forum powered with bitcoin for tipping. Join a community like bitcoin make submissions and comments and you can earn up to 250 bits. Which is 25000 satoshis.

3) Zebra

Zebra is a site rewarding you for looking at ads.

Think that is still ridiculous? Well Gavin Andresen was giving away up to 5 BTC in 2010. Back then it was worth only cents but close to $2000 today.

These links are safe to click and sites are safe to visit.

13 Ways To Earn Bitcoins

Links - Freebits

If you have time to spare try these links Freebits Try not to think of them as cents but satoshis. Their value years from now will be much greater

1) Bitpurge

To use this faucet you need to input your bitcoin address. Advisable to use a new address that is not your main bitcoin wallet. My recommendation is Kryptokit because it sits on your browser bar for easy access.

The faucet gives you 800 satoshis every 8 minutes and you can transfer it to your account balance after solving a captcha. When your balance reaches 10000 satoshis you can transfer it to your bitcoin wallet.

Does not mean that they will pay out!!

2) Zapchain

This is not truly a faucet. Zapchain is a forum powered with bitcoin for tipping. Join a community like bitcoin make submissions and comments and you can earn up to 250 bits. Which is 25000 satoshis.

3) Zebra

Zebra is a site rewarding you for looking at ads.

Sunday, November 29, 2015

Why Bitcoin - Many Reasons To Do Bitcoin

People depending on their circunstance will have different reasons to do bitcoin. Before you even consider investing, please be sure in your own mind that this thing is not going to go "pooof". For myself Bitcoin Is A Safe Bet. Make up your own mind. Bitcoin is an idea whose time have come.

Hedge Against Inflation

I got worried about my assets and savings when QE was introduced to save the economy. Everything shouts out at me that printing money can only lead to inflation and excessive money printing will lead to hyper-inflation like 1920's Germany.

However all we got was exploding Asset prices and not much inflation. An explaination as to why this is so can be found here. Banks have been mainly depositing their cash with the central banks. What happens when all that money finally gets into the real economy ? Scary. Banks are not lending because in a contracting economy there is little demand for productive investments. The only demand is for speculative investments in property and stocks. Would not surprise me if it turns out that banks are the biggest speculators.

I looked at Bitcoin after being introduced to it by my son. Studied it and felt that it was safe enough for me then and started buying a little each week. That was 2 years ago. My small investment in bitcoins have increased in value despite starting when the price of bitcoin was $600. As a hedge against inflation, the strategy has worked.

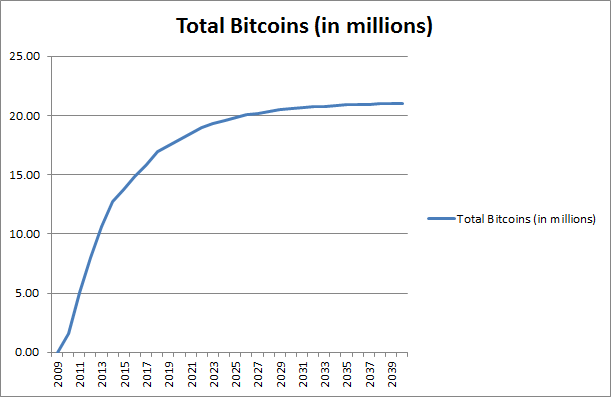

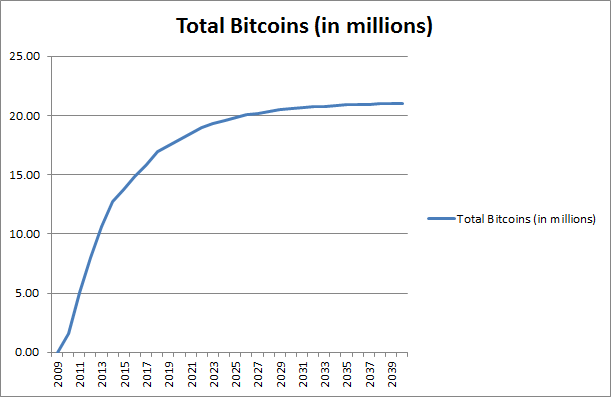

Bitcoin is guranteed to be limited to 21 million by maths. With increasing adoption by people all over the world its value can only go up, way up.

Planning For The Future

Most bitcoin early adopters are below 40. Saving for the future and bringing up a family is not easy. However for this generation bitcoin there is a once in a lifetime "bankable" option.

Consider possible future purchases by just saving 1 Btc today. Value $320

5 years - Buy a car

10 Years - Pay for children's education

20 Years - Buy A house

Depending on how much the price of bitcoin increases over the next 20 years these are possible outcomes. If you just left $325 in the bank there is no chance that it can achieve any of this growth. There is however, a strong chance that you will be earning negative interest. Your savings will actually decrease over time!

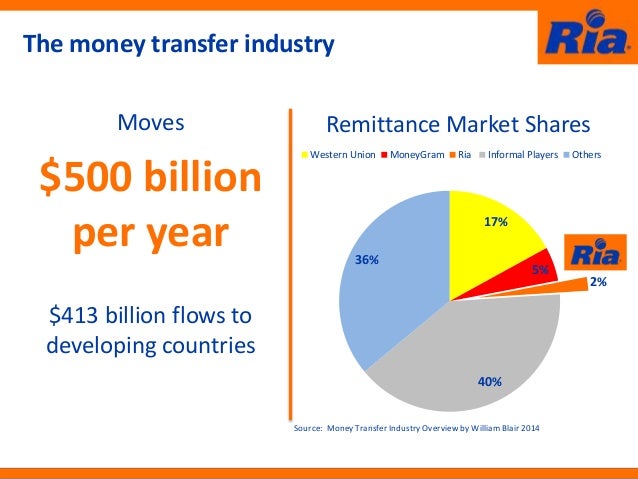

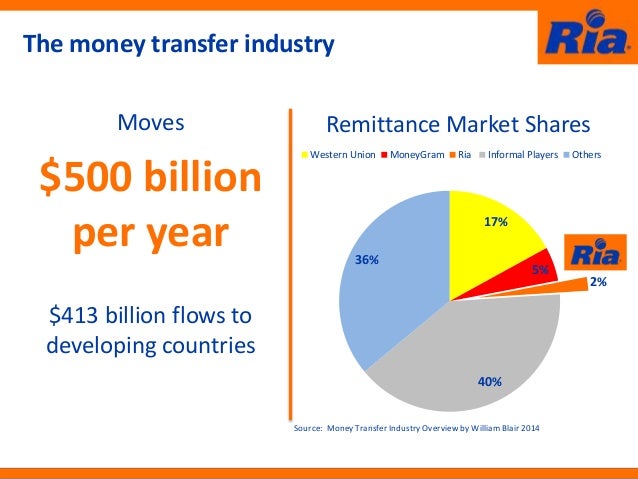

Remmitances

500 billion a year. Why is it so difficult to make a dent in this market? I thnk that this is the classic chicken and egg problem. Not enough places to spend bitcoins especially in developing countries and not enough people willing to spend bitcoins anywhere. Currency is still king and it will be hard to change that state of affair.

Like all catch 22 situations, someone will break that egg to make the omelette. When that happens the floodgates will open and we should see a huge surge in demand. Until then we can only wait..

Banking The Unbanked

Bitcoin can bring these 2.5 billion adults into the global economy. In the last 20 years China's growth have fueled the global economy. and yet China still has a large proportion of their adult population unbanked or underbank. Imagine the economic growth explosion that will emerge when marginalised people all over the world join the global economy.

Again it is the chicken and egg problem but perhaps, just as well, as we have yet to grapple with the sustainability aspect of this major change.

Gambling, Porn, Drugs, Crime and Terrorism

The dark and sleazy side of bitcoin usage. Without a doubt growth of the inernet was accelerated by the porn industry. Should we care? Should we design bitcoin to exclude such anti social activities before they take root ?

If money cannot be used for gambling, porn, drugs and crime then it is not very good money. Bitcoin psuedonymous and soon to be annonymous nature is a feature and should be guarded and never compromised. The work of enforcement agencies may be harder but then that is what they are paid to do. On the bright side, finding solutions around this problem may mean more jobs, and perhaps, even a new growth segment for the security industry.

Morals aside the march towards bitcoin use in this darker economy is on the up. Many casinos now accept bitcoin. Online gambling is quick latching on and micropayment channels will soon work its way into online porn.

Online Gaming

Incorporating monetary tokens into social gaming brings on a new dimension to the game. A big difference to current token systems is that bitcoin tokens can be used in-game and off-game. Starting with Hyper, there are even more serious and well funded initiatives from companies like Everdream soft's Spells of Genesis and Voxelus's Voxel in 3D gaming.

Everdream soft will be the first to market and with its already huge user base of 250,000 Moonga gamers, Spells of Genesis is almost assured of success when it launches in Q1 2016. Spells of Genesis is built on the counterparty platform and uses the bitcoin blockchain. How this will expand the useage of bitcoin is yet to be seen but one thing for sure is that it will introduce bitcoin to a whole new generation of young gamers.

Online shopping

The info graph shows the spending per online shopper in each country. Multiply by number of shoppers and you get an idea of the size of the market. It is in the trillions of dollars.

What is the big deal with Open Bazaar and how will it threaten the incumbents in this industry? Well Open Bazaar uses only bitcoin for it's payment system. In addition there are no buyer or seller fees, It is a platform, on which many entreprueners, companies and startups will be offering aggregation services much like Google with search. When the whole world offer products and services on this giant uncensorable platform we need the tools to find what we are looking for.

The important point is that bitcoin is the currency that drives this economy. It is the only way that a shoemaker in Zimbabwe can sell to a customer in Mongolia.

Trading and Speculation

Big movements in prices have been link to price speculations mostly emanating from China. The chinese are particularly disposed to risk taking. Just walk into any casino where the chinese form a minority of the population. They will be overrepresented as a proportion of the clientele. Only a very small amount of the chinese population in China have any exposure to bitcoin. This will change and with it price volatility trending upwards.

For those interested in trading their way to a fortune, be prepared for the wild wild west of 24/7 unregulated trading. Many exchanges have come and gone taking with them their clientele's money and bitcoins.

International Travel

Many travel companies will accept bitcoin for travel bookings. The biggest and one of the earliest is Expedia. Today there are also many companies offering bitcoin debit cards including Xapo and E-coin. Goes without saying that you first have to purchase your bitcoins.

Investing in Bitcoin startups

Because of the difficulty in assessing capital for bitcoin startups many were crowdfunded using bitcoins. Though angel investors have moved in of late, many startups still find that crowdfunding is the only way for them to gain access to capital.

The Next Generation

Every generation has it's breakout industry. We have the industrial revolution, the automotive, the computer, the internet and now fintech. Each new industry destroys jobs in the old and creates new ones in its place. There will be a rush to learn cryptography and blockchain technology just as there was a rush to learn computer science that many years ago, because, thats where the jobs are.

The young of today, will grow up with crypto currencies as second nature. They will be their own bank even before they can open a bank account. Their generation will grow up never needing the banking services that we now take for granted.

An industry that cannot keep itself relevant with its customer base is a sunset industry. Banking is on the decline. Brick and motar branches are being replaced with online apps. Backroom operations will be using blochchain technology to reduce staff numbers. The day will come when all the banking conglomerates will be replaced with names like Coinbase, Factom, Storj.

A financial crisis of enormous proportion is on the way. Our debt based economy have racked up so much debt that it is hard to anticipate how it will all unravel smoothly. More here.

Bitcoin Price Will Make Quantum Jumps

Bitcoin prices have always made quantum leaps every 2 years. I predict that the next price leap is to $600 early 2016. In part tied to the halving and huge rollout of apps and startups activity. I could be conservative.

Bitcoin Could Become A Defacto Reserve Currency

Bitcoin does not need to be officially nominted and adopted by IMF and the world bank. Just individual central banks holding some bitcoins will make it a defacto reserve currency. If this happens few individuals will be able to afford 1 whole bitcoin.

Econotimes : Study shows bitcoin may be a reserve currency

Get A Coinbase Wallet

1FSCmbGrKCHWTnKYaYSip9YTJVsCfVQ36T

Hedge Against Inflation

I got worried about my assets and savings when QE was introduced to save the economy. Everything shouts out at me that printing money can only lead to inflation and excessive money printing will lead to hyper-inflation like 1920's Germany.

However all we got was exploding Asset prices and not much inflation. An explaination as to why this is so can be found here. Banks have been mainly depositing their cash with the central banks. What happens when all that money finally gets into the real economy ? Scary. Banks are not lending because in a contracting economy there is little demand for productive investments. The only demand is for speculative investments in property and stocks. Would not surprise me if it turns out that banks are the biggest speculators.

I looked at Bitcoin after being introduced to it by my son. Studied it and felt that it was safe enough for me then and started buying a little each week. That was 2 years ago. My small investment in bitcoins have increased in value despite starting when the price of bitcoin was $600. As a hedge against inflation, the strategy has worked.

Bitcoin is guranteed to be limited to 21 million by maths. With increasing adoption by people all over the world its value can only go up, way up.

Planning For The Future

Most bitcoin early adopters are below 40. Saving for the future and bringing up a family is not easy. However for this generation bitcoin there is a once in a lifetime "bankable" option.

Consider possible future purchases by just saving 1 Btc today. Value $320

5 years - Buy a car

10 Years - Pay for children's education

20 Years - Buy A house

Depending on how much the price of bitcoin increases over the next 20 years these are possible outcomes. If you just left $325 in the bank there is no chance that it can achieve any of this growth. There is however, a strong chance that you will be earning negative interest. Your savings will actually decrease over time!

Remmitances

500 billion a year. Why is it so difficult to make a dent in this market? I thnk that this is the classic chicken and egg problem. Not enough places to spend bitcoins especially in developing countries and not enough people willing to spend bitcoins anywhere. Currency is still king and it will be hard to change that state of affair.

Like all catch 22 situations, someone will break that egg to make the omelette. When that happens the floodgates will open and we should see a huge surge in demand. Until then we can only wait..

Banking The Unbanked

Bitcoin can bring these 2.5 billion adults into the global economy. In the last 20 years China's growth have fueled the global economy. and yet China still has a large proportion of their adult population unbanked or underbank. Imagine the economic growth explosion that will emerge when marginalised people all over the world join the global economy.

Again it is the chicken and egg problem but perhaps, just as well, as we have yet to grapple with the sustainability aspect of this major change.

Gambling, Porn, Drugs, Crime and Terrorism

The dark and sleazy side of bitcoin usage. Without a doubt growth of the inernet was accelerated by the porn industry. Should we care? Should we design bitcoin to exclude such anti social activities before they take root ?

If money cannot be used for gambling, porn, drugs and crime then it is not very good money. Bitcoin psuedonymous and soon to be annonymous nature is a feature and should be guarded and never compromised. The work of enforcement agencies may be harder but then that is what they are paid to do. On the bright side, finding solutions around this problem may mean more jobs, and perhaps, even a new growth segment for the security industry.

Morals aside the march towards bitcoin use in this darker economy is on the up. Many casinos now accept bitcoin. Online gambling is quick latching on and micropayment channels will soon work its way into online porn.

Online Gaming

Incorporating monetary tokens into social gaming brings on a new dimension to the game. A big difference to current token systems is that bitcoin tokens can be used in-game and off-game. Starting with Hyper, there are even more serious and well funded initiatives from companies like Everdream soft's Spells of Genesis and Voxelus's Voxel in 3D gaming.

Everdream soft will be the first to market and with its already huge user base of 250,000 Moonga gamers, Spells of Genesis is almost assured of success when it launches in Q1 2016. Spells of Genesis is built on the counterparty platform and uses the bitcoin blockchain. How this will expand the useage of bitcoin is yet to be seen but one thing for sure is that it will introduce bitcoin to a whole new generation of young gamers.

Online shopping

The info graph shows the spending per online shopper in each country. Multiply by number of shoppers and you get an idea of the size of the market. It is in the trillions of dollars.

What is the big deal with Open Bazaar and how will it threaten the incumbents in this industry? Well Open Bazaar uses only bitcoin for it's payment system. In addition there are no buyer or seller fees, It is a platform, on which many entreprueners, companies and startups will be offering aggregation services much like Google with search. When the whole world offer products and services on this giant uncensorable platform we need the tools to find what we are looking for.

The important point is that bitcoin is the currency that drives this economy. It is the only way that a shoemaker in Zimbabwe can sell to a customer in Mongolia.

Trading and Speculation

Big movements in prices have been link to price speculations mostly emanating from China. The chinese are particularly disposed to risk taking. Just walk into any casino where the chinese form a minority of the population. They will be overrepresented as a proportion of the clientele. Only a very small amount of the chinese population in China have any exposure to bitcoin. This will change and with it price volatility trending upwards.

For those interested in trading their way to a fortune, be prepared for the wild wild west of 24/7 unregulated trading. Many exchanges have come and gone taking with them their clientele's money and bitcoins.

International Travel

Many travel companies will accept bitcoin for travel bookings. The biggest and one of the earliest is Expedia. Today there are also many companies offering bitcoin debit cards including Xapo and E-coin. Goes without saying that you first have to purchase your bitcoins.

Investing in Bitcoin startups

Because of the difficulty in assessing capital for bitcoin startups many were crowdfunded using bitcoins. Though angel investors have moved in of late, many startups still find that crowdfunding is the only way for them to gain access to capital.

The Next Generation

Every generation has it's breakout industry. We have the industrial revolution, the automotive, the computer, the internet and now fintech. Each new industry destroys jobs in the old and creates new ones in its place. There will be a rush to learn cryptography and blockchain technology just as there was a rush to learn computer science that many years ago, because, thats where the jobs are.

The young of today, will grow up with crypto currencies as second nature. They will be their own bank even before they can open a bank account. Their generation will grow up never needing the banking services that we now take for granted.

An industry that cannot keep itself relevant with its customer base is a sunset industry. Banking is on the decline. Brick and motar branches are being replaced with online apps. Backroom operations will be using blochchain technology to reduce staff numbers. The day will come when all the banking conglomerates will be replaced with names like Coinbase, Factom, Storj.

A financial crisis of enormous proportion is on the way. Our debt based economy have racked up so much debt that it is hard to anticipate how it will all unravel smoothly. More here.

Bitcoin Price Will Make Quantum Jumps

Bitcoin prices have always made quantum leaps every 2 years. I predict that the next price leap is to $600 early 2016. In part tied to the halving and huge rollout of apps and startups activity. I could be conservative.

Bitcoin Could Become A Defacto Reserve Currency

Bitcoin does not need to be officially nominted and adopted by IMF and the world bank. Just individual central banks holding some bitcoins will make it a defacto reserve currency. If this happens few individuals will be able to afford 1 whole bitcoin.

Econotimes : Study shows bitcoin may be a reserve currency

Get A Coinbase Wallet

1FSCmbGrKCHWTnKYaYSip9YTJVsCfVQ36T

Subscribe to:

Posts (Atom)