This bear market is a “forrest fire” raging through the crypto ecosystem. It is necessary for a healthy ecosystem to clear the deadwood and allow new more resilient shoots to sprout and grow. What is important is to take stock of your position understand the changes and identify which are the new and innovative unicorns. Do this without the baggage and drag and of emotional attachments to any pet projects. It is your money and your future.

You may have lost a good part of your investment, but it is relative. The ratio of your crypto worth is still the same. Re-evaluate your investment strategy and spot those unicorns that are sure to appear. They are usually the silent ones. Above all remember it is only money, and when one door closes another opens.

If you need empathy hope and direction, this video will help you reset your bearings.

After The Fire.

You will no doubt hear all the reasons why the bear market set in. Perhaps they all play a part but really going back to history and saying crypto have always drop 90% and then risen to new heights, therefore just hoddle, think again. History does not repeat. It Rhymes. The conditions of the future are different from the past.

A blockchain without a token is just another database. BTC is just another token. It may not survive or more likely remain in its’ premium position but blockchain technology will change, evolve and improve. Take a wide angle look at this space. Like transport technology, we needed the horse and buggy to develop the automobile and the formula one speedster. Take a critical unemotional look at your pet projects. This space moves faster than the internet age. Ten years is too long for a project to be still in its’ infancy. More likely the evolution have taken place and you have been left behind.

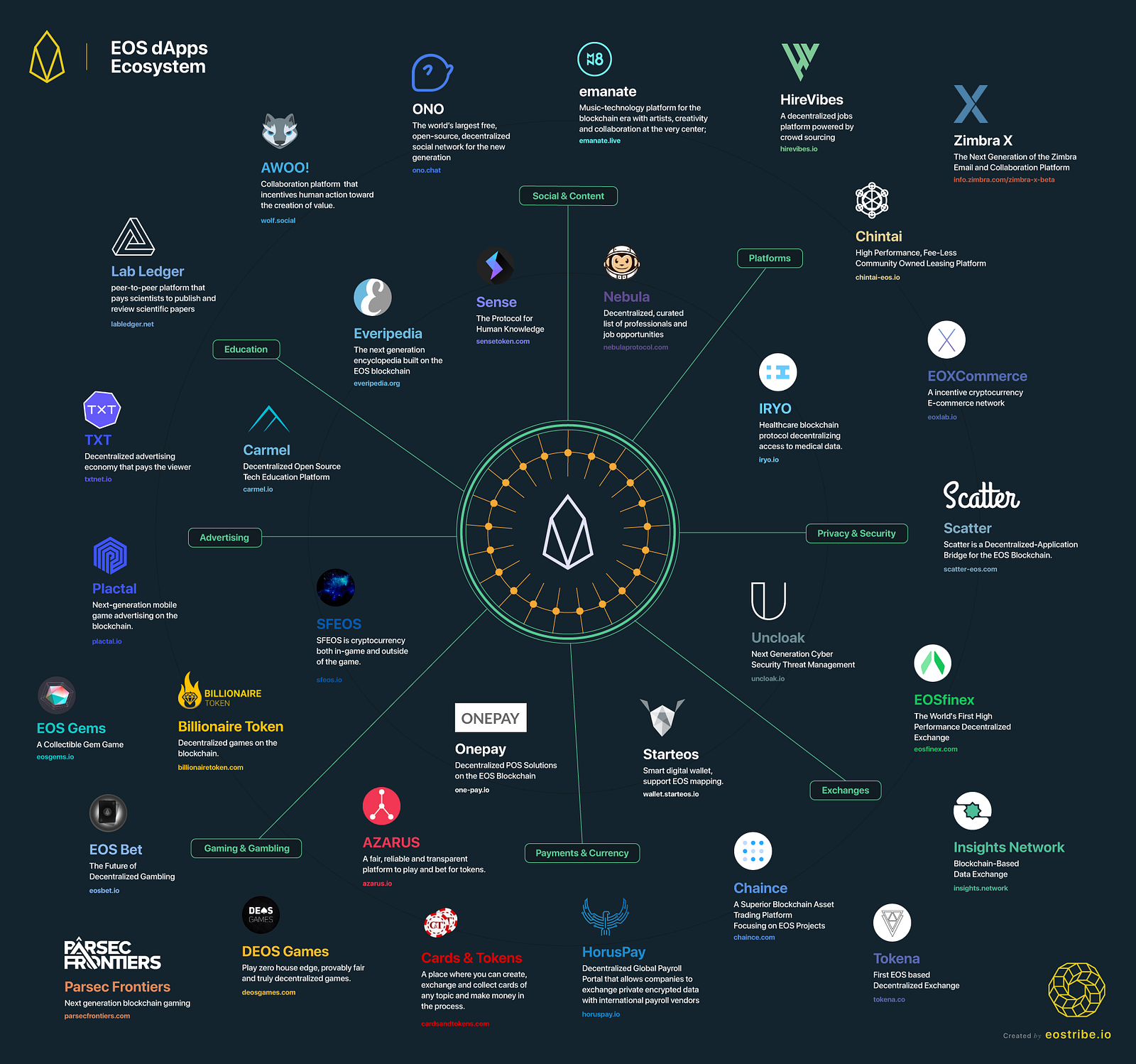

Blockchain is an internet technology. If your project is not growing then it is dying. That is the unemotional unvarnished truth. Blockchain technology have moved from BTC to Ethereum to EOS. There is a whole new ecosystem built around EOS. This ecosystem is growing and gaining new users everyday.

Eos Knights – 3700 daily users and growing. You can earn real money (EOS) by mining and crafting items. Businesses will set up to do this on an industrial scale because there is a real revenue stream here. Users spend an average of $6 a day on Eos Knights compared to about 30 cents per month on the most popular online game today. The gaming industry have taken notice and are rushing to build and incorporate blockchain technology into their products. This is only possible today on the EOSIO platform.

BetDice, EosPoker and a host of other gambling dapps are launching on the EOS platform. Developing on the EOS blockchain bypasses the licencing, identity and fiat on/off ramp issues. They are designed to transition into Decentralised Autonomous Corporations and so be impossible to shut down. Currently, for the investor returns of 1% a day is the norm. This situation will not last. Price of tokens in the best of these DAC will rise to reflect a more normal rate of return.

EVA will disrupt the ride share industry because it gives most of the income and control back to the drivers and users. Everipedia will replace Wikipedia because a system will be in place to rank and value truth and facts. EDNA seeks to give back control of bio-metric information to the individual. Of course it is only logical that new versions of Youtube, Facebook, Instagram, Wechat will launch, moving away from push ad based systems where your private information is a commodity to these behemoth. A new email system will arise where unsolicited spam will be a thing of the past.

The most interesting aspect of the EOS blockchain is free transactions. Because of this it will be possible to introduce Universal Basic Income. The concept that every living person on this planet will have access to a basic income. We are moving into a new future where the concept of work, jobs and income will change. When we solve fusion power, which is looking promising, hunger will be a thing of the past. We will be able to synthesise our food and reshape our environment with abundance of free energy. Payments can be made instantly and for free to every account in the system. The only question is where this new wealth for distribution will come from. Dan Larimer proposes his concept of Universal Resource Income where the income from resource trading on the EOS blockchain is distributed. I have no doubt that something like this will be the future as the economy depends on people spending and discouraging uneconomic static wealth accumulation.

How will this bear market play out?

The IMF have advised governments to look into blockchain currencies. Venezuela have introduced the Petro, Iran have indicated that they want to develop a digital currency. The biggest hurdle that they will encounter if they use a private blockchain is recruiting an army of developers, security and a useable wallet.

The only viable solution is to develop on a public blockchain and that blockchain will be EOS. A government can effortlessly issue their national currency on the EOS blockchain. They will have full control over its’ issuance, be able to give their citizens full transparency over monetary and fiscal policies, security, free instant transactions and have many mobile wallets to choose from.

With Bancor these currencies, even if they are on sister chains and be moved effortlessly from one to the other effectively solving the problem of currency translation. Perhaps the concept of a stable coin is unnecessary. Value can just be moved and interchange from one to another through the Bancor network.

This brings us back to the existing bear market. How will it play out? Coins don’t die. Each will have its’ own band of converts and die hard users. The value of each will depend on utility and user base. EOS will probably become the most valuable token and most used blockchain. BTC may evolve to be a digital asset and a store of value. Money will remain the purview of governments and be used as the prime legal tender within their own boundaries with the assurance that if they abuse this privilege their citizens will simply switch to another token.

Finally, please beware. These are only my predictions and not facts. Critique the reasoning behind and do your own research. Good Luck.

If you wish to tip me, you can do so with BSV.

If you wish to tip me, you can do so with BSV.